Merchant Cash Advance

We have partnered with YouLend to bring you simple, flexible funding to use for any business purpose.

Designed as an alternative to traditional bank loans, you can apply for funding from £5k to £1m, in just a few clicks.

- Receive your quote in 24 hours

- 90% approval rates

- One all-inclusive cost known upfront

- No security or business plans required

How it works with Simply Business Loans

At Simply Business Loans we have partnered with YouLend who have been trusted by over 150k+ merchants to grow their business with cash advances.

Receive funds quickly

Quotes in less than 24 hours and receive funds directly in to your bank account.

Repay as you earn and transparent pricing.

Repay a fixed % of daily sales and one flat fee agreed upfront.

Flexible top ups

One you’ve been approved you can receive funding top ups on the same day.

Why YouLend?

Whether its to invest in advertising, boost cash flow, renovating or staff hire, YouLend delivers innovative and flexible funding solutions and have been trusted by over 150,000 merchants.

They approve 9 out of 10 of eligible businesses for funding who have been actively trading for at least 3 months and are making more than £5,000 in monthly sales online or via card terminals.

YouLend will typically provide you with a quote on the same day you apply, and you can use that funding for any business purpose. You are not charged interest and repayment works on a pre-agreed fixed percentage of sales and on days without sales, you will not repay anything.

One you’ve been funded by YouLend, you can apply for top ups which are usually received the same day if approved and can make one off repayments free of charge.

A Guide to Merchant Cash Advances

A merchant cash advance (MCA) can be a valuable funding option for small businesses and SMEs that rely on card payments.

Here are some of the key features you will often see with MCAs and how comparing them with other loan options can help you save money.

Flexible Funding Based on Card Sales: Provides an upfront lump sum based on a business’s historical credit/debit card sales.

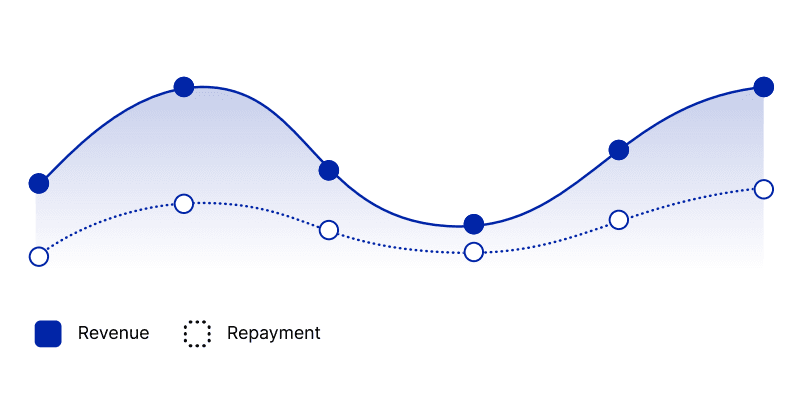

Repayment Through Daily Card Sales: A fixed percentage of daily card sales is automatically repaid to the lender. This offers repayment flexibility, especially for businesses with fluctuating revenue.

Fast Approval and Funding: Applications and funding are usually processed quickly with this type of funding.

No Fixed Interest Rate or Terms: Instead of interest, lenders charge a fixed factor rate.

Unsecured Financing: Home Owners and non-Home Owners are eligible

Whether its stocking up to meet demand , investing in new projects, or simply boosting your cash flow, you can now access fast and flexible funding to help your business grow.

Revenue Based Repayments

A fixed percentage of your daily sales (typically 5 – 20%) will go towards repaying the finance automatically

Well-Suited Businesses:

- Retail and Hospitality Businesses:

Overview: Ideal for restaurants, cafes, shops, and other businesses with consistent card transactions.

Reason: Repayments are directly linked to card sales, making MCAs suitable for these sectors.

- Seasonal Businesses:

Overview: Useful for businesses with seasonal fluctuations, like tourism-related companies.

Reason: Payments reduce during low seasons when sales drop.

- Growing Businesses Needing Quick Cash:

Overview: Businesses expanding rapidly or needing to cover short-term expenses.

Reason: Fast approval and flexible repayment.

About This Information

Our articles, guides & reviews are provided as generic information only. Any expressed view, product or service mentioned within these does not constitute as financial advice or recommendation by us.

Be mindful that information may have changed since publication.